Understanding Market Concerns When Prices Are High

The stock market keeps hitting new record highs, and artificial intelligence-related stocks have been performing especially well. This has led some people to wonder: "Is the market in a bubble?" These concerns are common, but worrying too much about bubbles can lead to poor choices. Investors might try to time the market or make quick trades instead of sticking to their long-term plans.

A market "bubble" is hard to define precisely. Markets go through natural cycles, and how people view risk changes over time. Yes, there have been real bubbles in the past - like the dot-com crash in the late 1990s and the housing crisis in the mid-2000s. But there have been many more times when investor worries never came true. After the 2008 financial crisis, many people feared another bubble was forming. Instead, the market went on to have its longest-ever period of growth.

The question "Is this a bubble?" is different from "Will the market go down?" Short-term drops in stock prices are normal and can happen at any time. Earlier this year, the S&P 500 fell 19% but recovered in less than three months. Investors who sold during the decline and stayed out of the market likely missed the recovery.

Stock prices are high, but context matters

To understand whether we're facing a temporary drop or a real bubble, we need to look at value. When you buy a stock, you're buying a share of a company and its future profits. Valuation measures (like price-to-earnings ratios) help us see if the price we're paying makes sense based on what we're getting.

The chart shows the Shiller price-to-earnings ratio, which looks at long-term value by using earnings from the past ten years (adjusted for inflation). Today's level of 38x means investors are paying $38 for every $1 of past earnings. This is higher than the historical average of 27x.

Even though stocks look expensive by historical standards, there are a few important things to remember. First, high valuations don't reliably predict near-term returns. They simply show how much investors are willing to pay based on their expectations. Markets can keep rising for months or years even when prices seem high, as long as companies keep performing well.

Second, today's situation is different from the 1990s tech bubble in important ways. Back then, many dot-com companies had no profits. Today's leading companies are established, profitable, and financially healthy. Just as past technology advances helped many types of businesses, artificial intelligence could do the same.

Not all parts of the market are expensive

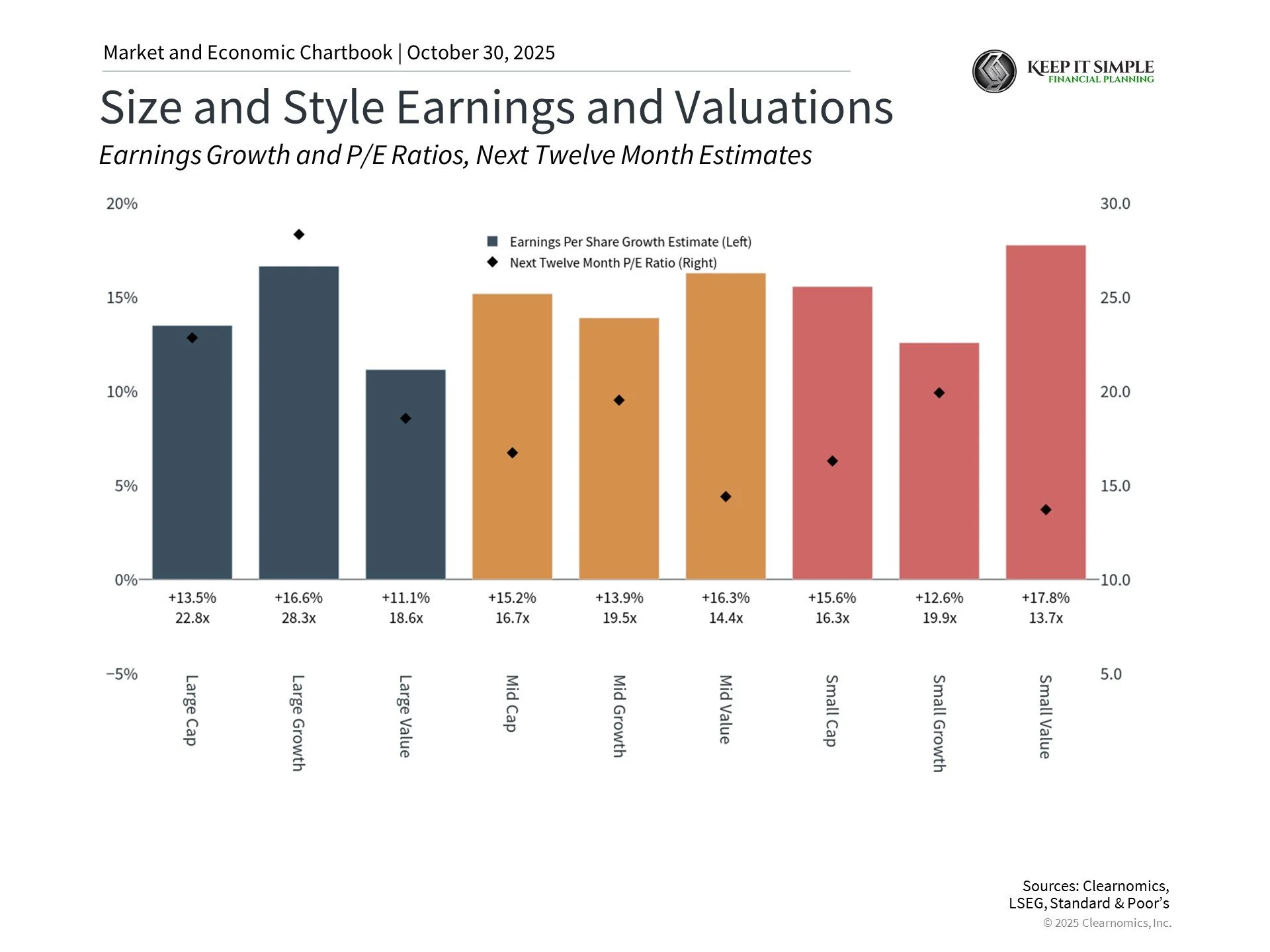

While the overall market looks pricey, some areas offer better value. The chart shows that Large Cap Growth stocks have the highest price-to-earnings ratio at 28x. Other types of stocks, including Large Value and Small Caps, have more attractive prices while still showing solid earnings growth.

The same is true across different sectors. Artificial intelligence companies are mainly in the Information Technology, Communication Services, and Consumer Discretionary sectors. Recently, other sectors with better valuations - like Financials and Industrials - have also been performing well.

Including different types of stocks in your portfolio helps reduce "concentration risk" (having too much in one area) and can improve your overall portfolio value. Since it's hard to predict which areas will perform best, holding a mix can help create better balance.

Time is a powerful tool for investors

One of the most important lessons from market history is that time rewards patient investors, even those who invest when prices are high. The chart shows that major market events look less dramatic when you zoom out over years and decades. Both the tech bubble and housing crisis were followed by recoveries and new all-time highs.

This highlights the value of strategies like dollar cost averaging (investing regular amounts over time). Even people who invested at the worst times in history - like right before the Great Depression in 1929 - made money if they stayed invested long enough.

The bottom line? Today's market prices are high, but companies are performing well. The key is having a diversified portfolio that can grow while managing risk. Working with a professional can help you build the right strategy.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.