Understanding the Magnificent 7 and Portfolio Balance

The big question for investors today isn't whether artificial intelligence (AI) will change the economy. It's how to keep your investment portfolio balanced as the stock market reaches new highs. While it might seem smart to only invest in companies that have done well recently, building wealth over time requires a careful approach to both growth and managing risk.

Large technology stocks, including those doing well from AI trends, are often called the "Magnificent 7." These stocks - Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla - now make up about 35% of the S&P 500 index. Several of these companies are called "hyperscalers" because they spend a lot of money on computer systems to handle the growing needs of AI programs.

New technology has always driven markets higher

AI and railroads might seem very different, but history shows that game-changing technologies often follow similar patterns. In the 1860s, railroad companies dominated American stock markets just like technology companies do today. The Pennsylvania Railroad was once the largest company in the world.

This pattern has happened many times throughout history. The dot-com boom of the 1990s is a recent example when investors focused almost entirely on internet companies. Going back further, the telegraph, electric power, and telephones all transformed cities and created new companies. Each wave followed a similar pattern: doubt, quick adoption, market excitement, and then becoming part of the normal economy.

For long-term investors, it's important to think about how new technologies affect the whole market and economy, not just individual companies. The real impact of innovation is making all businesses more productive and efficient.

Stock prices matter as much as growth

Today, the question isn't whether AI will be important, but whether current stock prices make sense. The S&P 500 is trading at a price-to-earnings ratio of 22.5x, which is close to the all-time high of 24.5x. This means investors are paying high prices that assume these trends will continue at the same pace.

What's causing high valuations for the Magnificent 7? First, U.S. private AI investment reached $109 billion in 2024. Second, many companies and regular users have quickly started using AI tools, creating more demand for computing power. This explains why companies like Microsoft and NVIDIA have seen their market values soar to over $4 trillion each.

The challenge is that markets often overestimate how quickly new technologies will make profits. The 1990s offer a warning. During that time, some investors believed traditional ways of valuing internet companies no longer applied. When reality didn't meet expectations, the Nasdaq fell 78% from its peak.

Balancing opportunities with concentration risk

While the Magnificent 7 companies have led the market higher, they have also led it lower. In 2022, when interest rates rose quickly due to inflation, these stocks dropped about 50% on average.

Since the Magnificent 7 now represents such a large portion of major market indexes, almost all investors have these stocks in their portfolios. Holding too much of a portfolio in just a few investments is called "concentration risk," which is the opposite of diversification (spreading investments across many different assets).

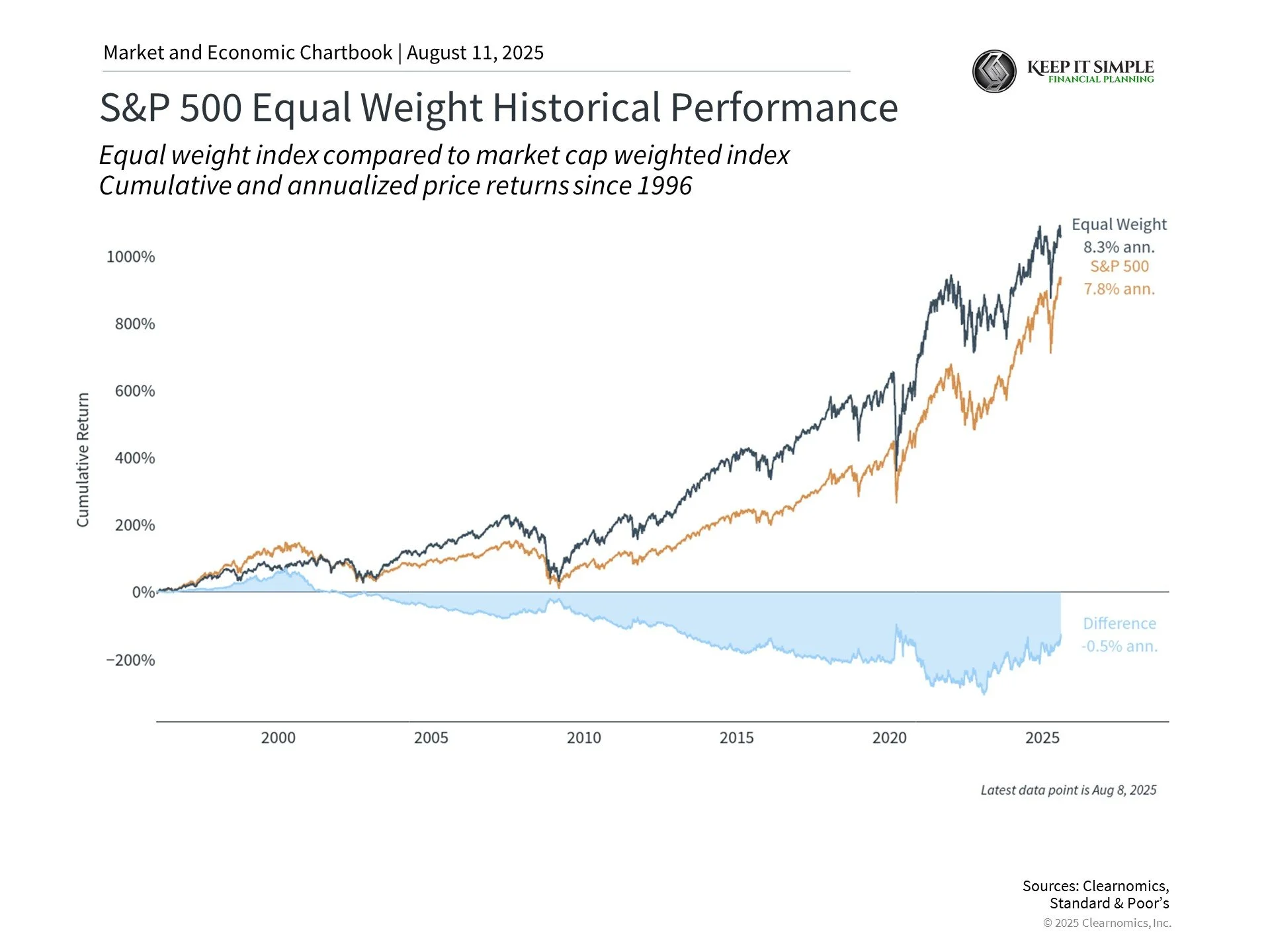

Consider the equal-weighted S&P 500 shown in the chart above, which gives the same importance to each company regardless of size. This approach has historically provided different return patterns than the standard index, sometimes performing better when large companies struggle. Over the past 30 years, the equal-weighted index has actually outperformed despite recent mega-cap tech success.

The bottom line? Current AI trends offer both opportunities and risks to investors. Financial success is not about picking winning stocks, but maintaining an appropriate portfolio balance aligned with long-term goals.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.