August Market Update: Stocks Hit New Highs Despite Economic Uncertainty

Stock markets reached new record highs in August, and bonds also helped investor portfolios grow. This happened even though there were concerns about tariffs, the Federal Reserve (the Fed), and technology companies. The month started with new U.S. tariffs on most major trading partners after a 90-day waiting period ended. Later, a federal court said these "reciprocal tariffs" are illegal, which might lead to a Supreme Court case.

Markets dropped in the middle of the month because investors worried the Fed might keep interest rates high to fight inflation. Recent price reports showed that companies are starting to charge consumers more because of tariff costs. But markets recovered when companies reported better earnings than expected and investors became more confident the Fed would lower rates in September.

Economic data was mixed. The economy grew 3.3% in the second quarter, which was better than the first estimate of 3.0%. This was much better than the first quarter's 0.5% decline. However, the monthly jobs report showed fewer new jobs than expected, and previous months were revised down significantly. This led to changes at the Bureau of Labor Statistics, adding to market uncertainty.

Companies reported strong earnings growth

While daily news can move markets short-term, company earnings and stock prices matter more for long-term returns. Stock valuations (how expensive stocks are) remain high, but this makes sense because companies continue to grow their profits at a good pace.

The latest earnings reports show that 81% of S&P 500 companies did better than expected, according to FactSet. This is the highest percentage since late 2023, showing the economy and companies are stronger than many thought.1 It also shows how well companies can adapt to tariffs and find ways to grow despite uncertainty.

Many investors focus on the Magnificent 7, a group of very large technology companies worth trillions of dollars. This group now makes up over one-third of the S&P 500 index. Their earnings were mixed overall, but some did better than expected, helping drive markets higher in late August.

The Fed is expected to lower interest rates

Companies that sell directly to consumers had mixed results as household spending patterns changed. Tariffs made this worse as companies passed more costs to consumers. Combined with weak job data, markets began expecting the Fed to cut rates starting in September.

Fed Chair Jerome Powell gave the clearest signal yet that the central bank is ready to start lowering interest rates again. The Fed has two main goals: keep inflation steady and unemployment low. They kept rates high this year because of stubborn inflation and a strong job market. Now, early signs of job market weakness could lead them to carefully cut rates.

Lower rates could help different types of investments

The possibility of Fed rate cuts could create opportunities across different investments. Lower rates can help the economy grow, make it cheaper for companies to borrow money, and increase the value of future company profits. For bonds, lower rates make existing bonds more valuable since they were issued when rates were higher.

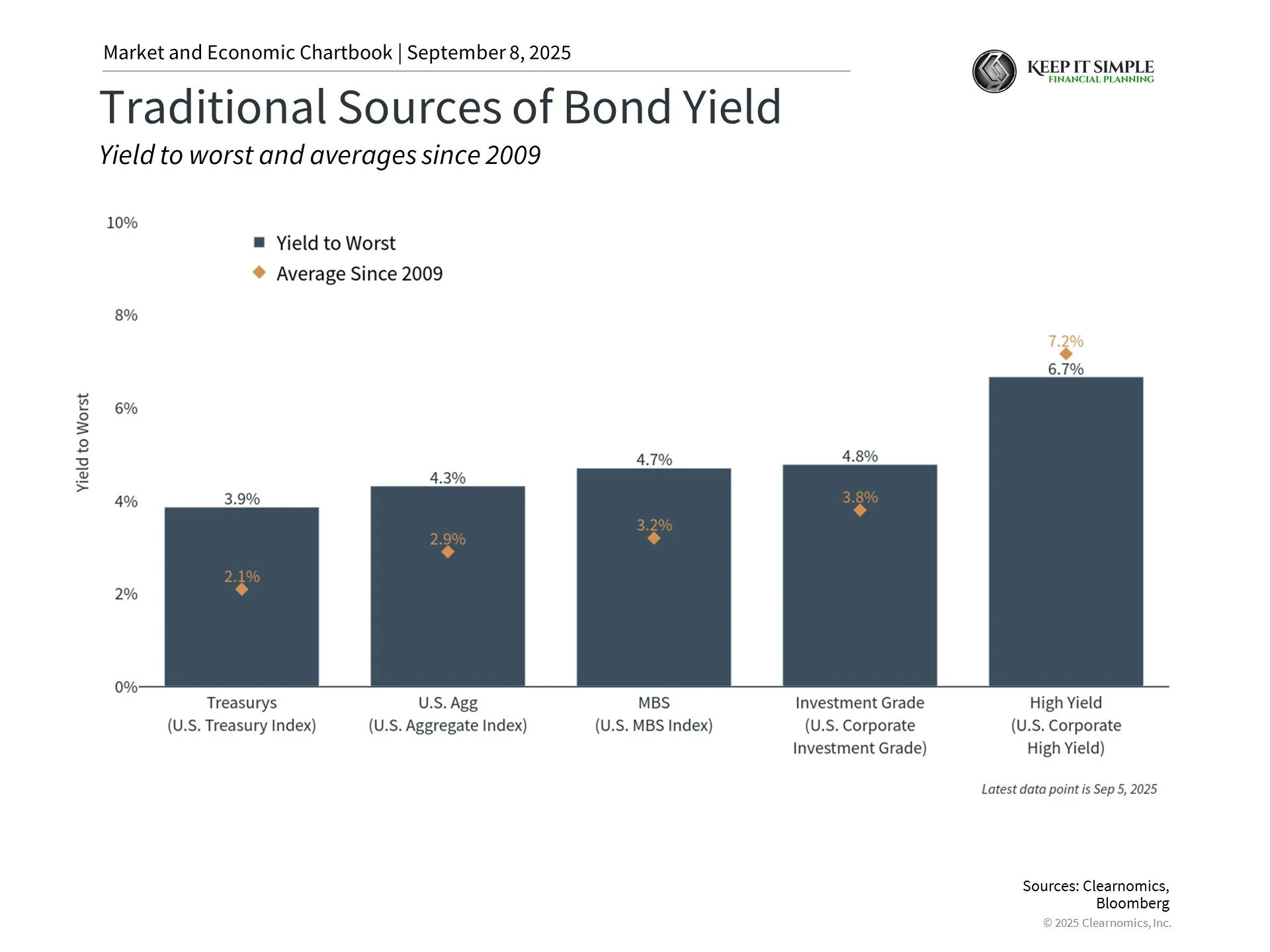

Bond yields (the income bonds pay) have stayed in a narrow range this year, with 10-year Treasury bonds yielding between 4.0% and 4.5%. Even if short-term rates fall, many bond types are providing good income levels. U.S. bonds overall yield 4.4%, corporate bonds yield 4.9%, and high-yield bonds yield 6.7%. These are well above historical averages.

For overall portfolios, investors should keep focusing on managing different risks and returns. Issues like tariffs, Fed policy, and potential government shutdowns are just some challenges ahead. Rather than reacting to each event, holding a balanced portfolio that can handle these swings while providing income and long-term growth is the best approach.

The bottom line? Markets hit new highs in August despite policy concerns. Strong company earnings and economic growth continue to support portfolios despite ongoing uncertainty.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.

1.https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_082925.pdf