Understanding Jobs and Mixed Economic Signals

Investors often look at past data even though the future matters most. Recent reports show mixed economic signals that worry some people about a possible recession. The job market is slowing and prices remain high, but unemployment is still low and the overall economy continues to grow. For long-term investors, these mixed signals make it important to stay balanced.

Looking at economic data is hard, and understanding market trends is never simple. During times like these, it helps to focus on the basics of the economy rather than news headlines. The best place to start is looking at how consumers are doing financially. This matters because consumer spending makes up over two-thirds of all economic activity.

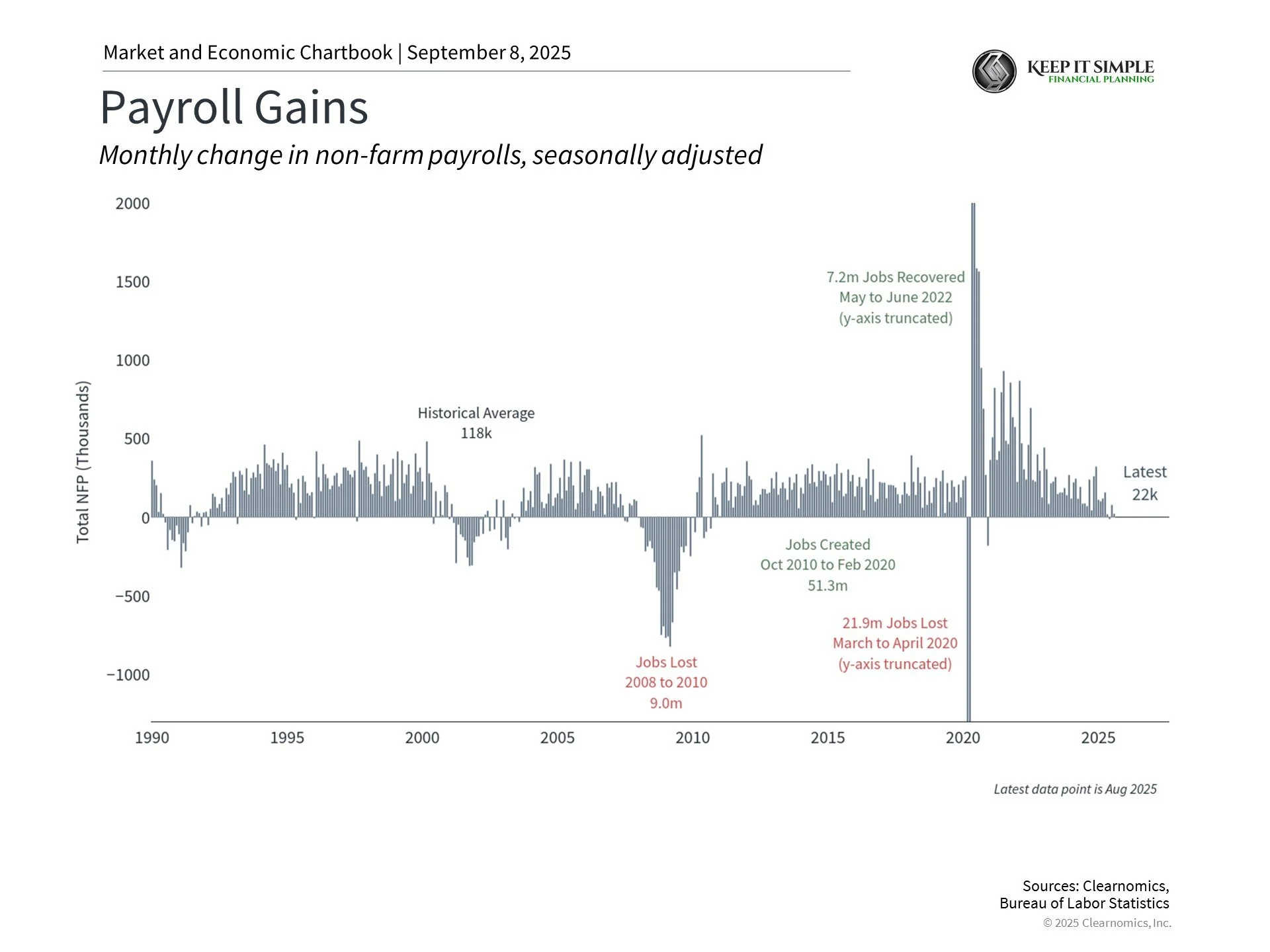

The job market has gotten weaker recently

To understand how consumers are doing, we need to look at jobs. The latest jobs report showed the job market is slowing more than expected. Only 22,000 jobs were added in August, much lower than the 75,000 economists predicted. The report also changed previous months' numbers, showing the economy actually lost 13,000 jobs in June - the first job loss since 2020.

While these numbers are important, economists don't just look at monthly job numbers since they can change a lot from month to month. Instead, they look at trends and something called "labor market slack." This simply means whether people looking for work can find jobs.

Fed Chair Jerome Powell recently said the job market is in "a curious kind of balance" because both the number of workers and demand for them have slowed.1 The unemployment rate is only 4.3%, which is good news since it means most people who want to work can find jobs. The "under-employment" rate, which includes people who have given up looking, is also low at 8.1%. Other reports show there is roughly one job opening for each unemployed person.

Consumer finances show strength despite challenges

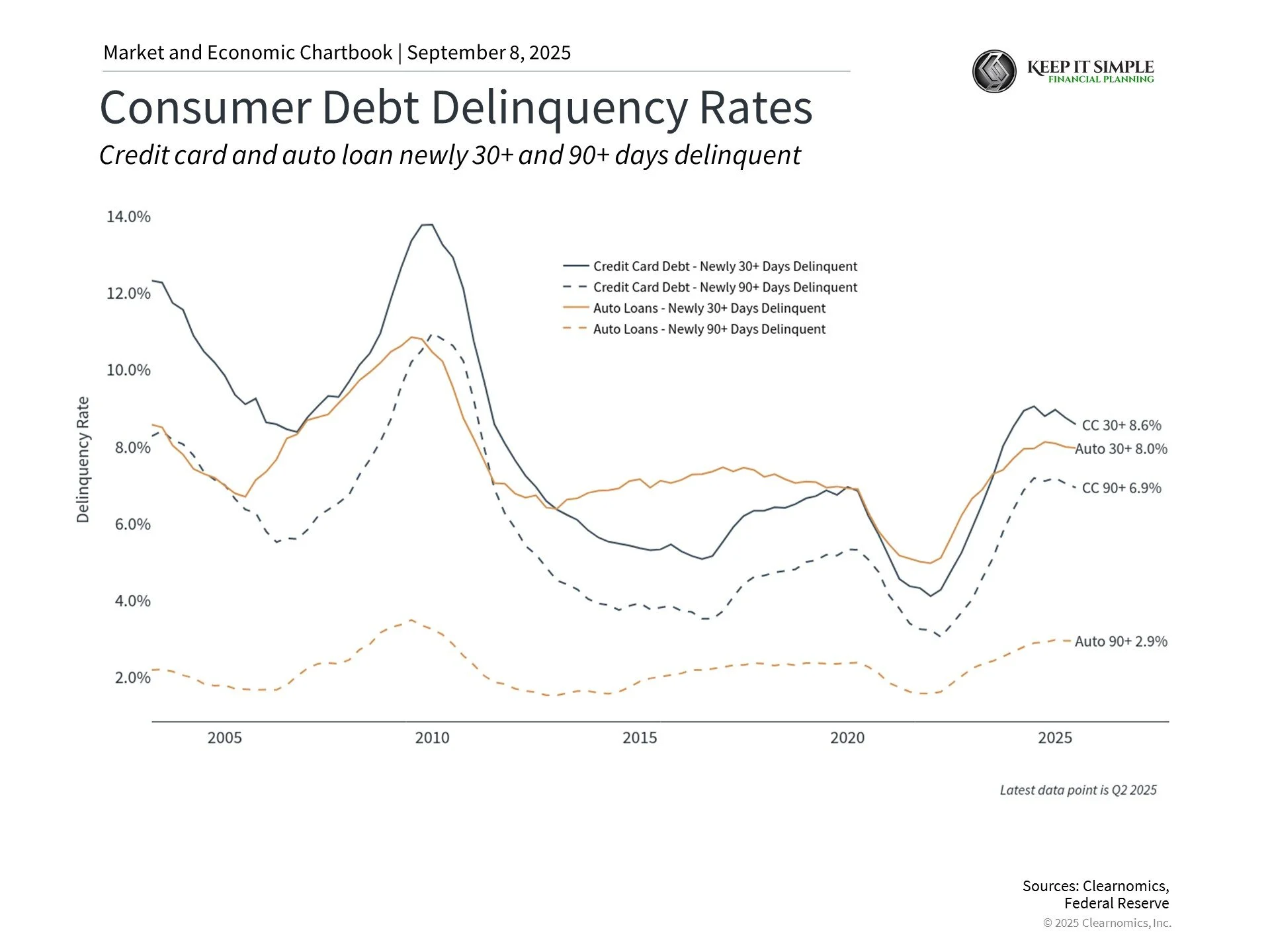

While the job market is cooling, consumer finances show a "two-speed economy" - meaning different groups of people have very different financial situations. Total debt continues to rise across credit cards, car loans, student loans, and more. High household debt can be a problem if the economy gets worse, like what happened in 2008.

One way to see if household finances are in trouble is to check if people are paying their bills on time. The chart shows that credit card and car loan late payments have increased over the past two years. This is partly due to people borrowing more money and higher interest rates. These problems are mostly concentrated among people with lower credit scores.

However, these late payment rates have leveled off recently and remain much lower than before 2008. While total debt is high, the amount households are paying on their debt has stayed flat in recent months. This suggests that while some families may feel stretched paying their loans, these numbers are not yet at levels that have historically caused recessions.

Household wealth remains near record highs

It's easy to focus only on debt, but assets (what people own) are just as important. U.S. household net worth (assets minus debt) remains near record levels at $169 trillion. This wealth has grown over the past 15 years due to steady economic growth, rising home prices, and strong stock market returns.

This reflects the two-speed economy since households that borrowed more may not be the same ones benefiting from rising asset prices. Still, this wealth effect - where rising asset values support consumer spending - can help provide economic stability. This is one reason why many concerns over the past few years have not always led to a weaker economy.

The bottom line? While the job market has slowed and may lead to Fed rate cuts starting in September, it is only one part of the overall economic picture. When the outlook is uncertain, investors should focus on underlying economic trends to stay balanced in their portfolios.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.

1. https://www.federalreserve.gov/newsevents/speech/powell20250822a.htm