How a Weaker Dollar Affects Your Investments

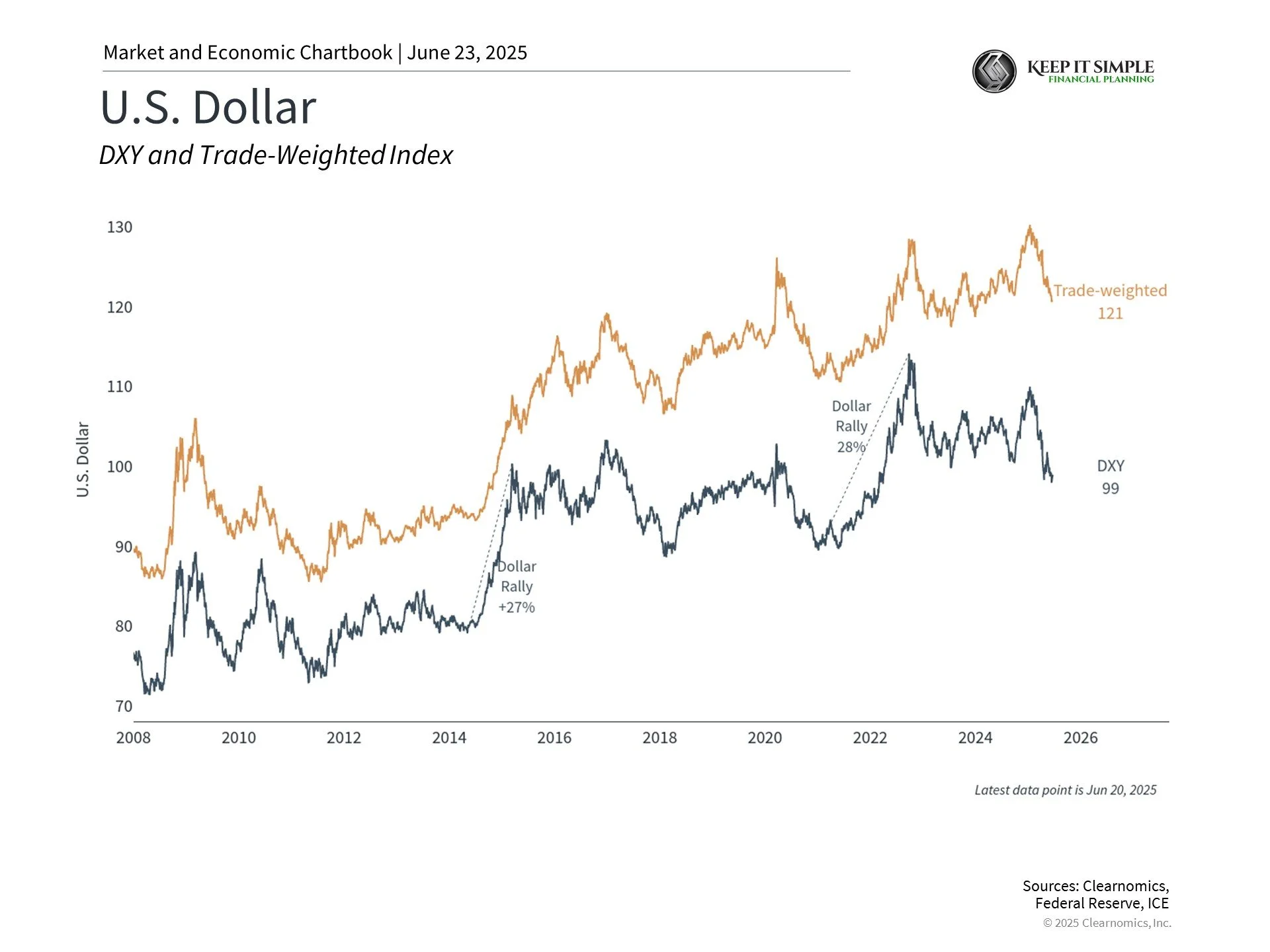

Many Americans see the U.S. dollar as a sign of America's strength in the world. But lately, the dollar has gotten weaker compared to other countries' money. It's now at its lowest point in three years. This has some people worried that the dollar might lose its important role in the world.

For people who invest money, it's helpful to understand how the dollar works and what makes it go up or down. Let's look at what's happening with the dollar and how it might affect your investments.

The dollar's important role in history

The U.S. dollar has been the world's main currency for about 100 years. This means most countries use it for big trades and keep it as savings. Some people worry that other countries' money or even digital currencies like Bitcoin might take over this role.

But these worries aren't new. In the 1980s, people thought Japan's currency might become more important than the dollar. When Europe created the euro in the 2000s, some thought it would replace the dollar too. None of this happened.

The dollar has stayed important because America has strong financial markets and stable institutions. When there's trouble in the world, people still see the dollar as a safe place to put their money.

Strong vs. weak dollars: both have pros and cons

A strong dollar makes it cheaper for Americans to travel abroad and buy things from other countries. But it also makes American products more expensive for people in other countries to buy. This can hurt American companies that sell things overseas.

A weak dollar does the opposite. It makes American products cheaper for other countries, which can help American businesses. But it makes imports more expensive for Americans.

What makes the dollar's value change

Many things affect how much the dollar is worth. One big factor is trade. When other countries buy American goods, they need dollars to pay for them. This makes the dollar stronger. When Americans buy more from other countries than we sell to them (called a trade deficit), it can make the dollar weaker.

America has been buying much more than it sells for many years. Last year, we bought $1 trillion more than we sold to other countries. Normally, this would make the dollar much weaker, but other factors keep it strong.

Interest rates also matter a lot. When the Federal Reserve (America's central bank) sets higher interest rates than other countries, investors want to buy American bonds and investments. This creates more demand for dollars.

The dollar is still important globally

Even though the dollar has gotten weaker recently, it's still much stronger than it was 20 years ago. It's important not to worry too much about short-term changes.

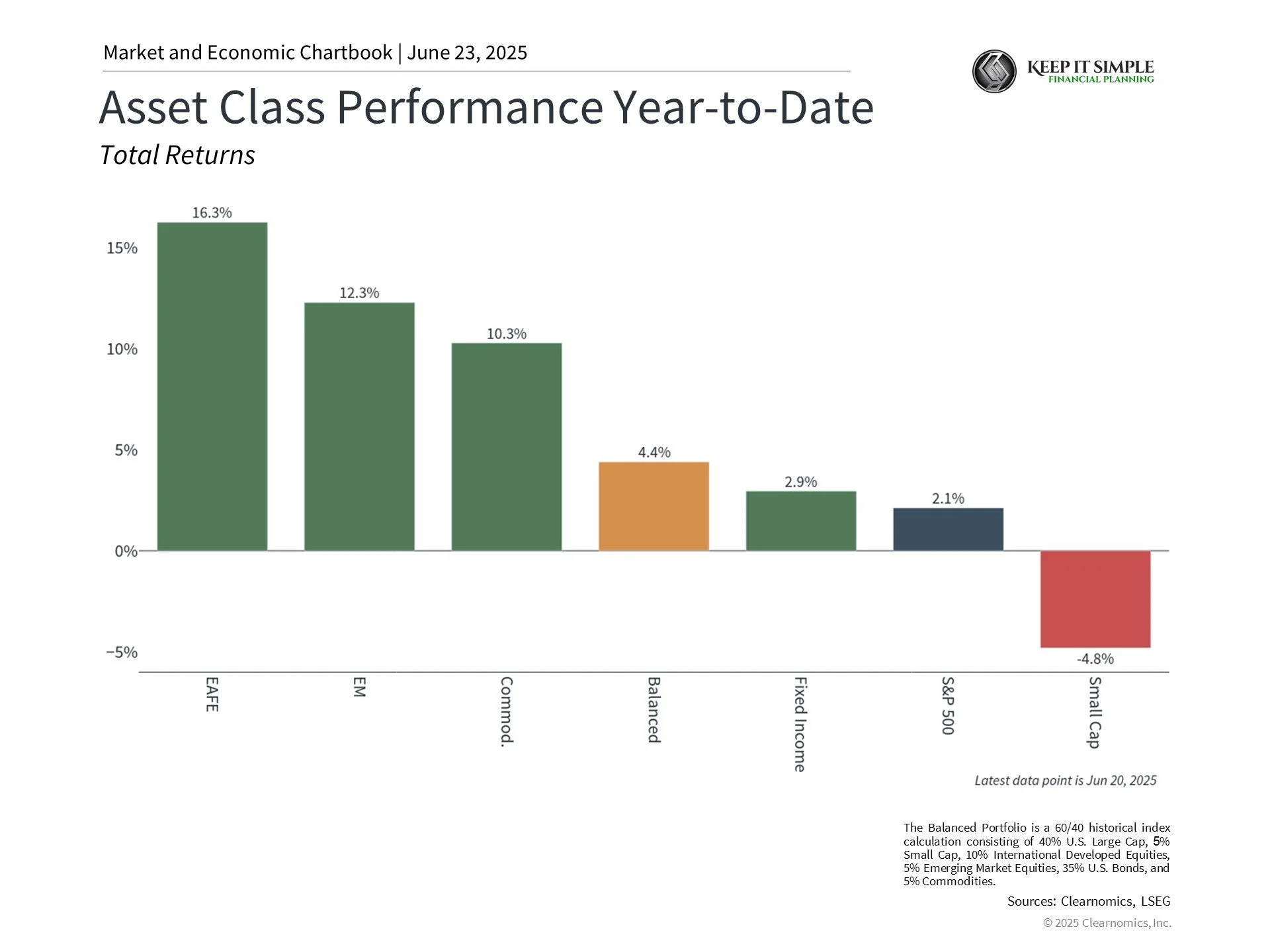

For investors, a weaker dollar has actually been good this year. When you invest in other countries and their currencies get stronger compared to the dollar, your investments are worth more. Foreign stock markets have done better than the American stock market this year partly because of this.

The bottom line? The dollar is still the world's most important currency, and a weaker dollar has helped investors who own foreign investments. It's best to think about the dollar's changes over the long term, not just what happens day to day.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.