Understanding Gold's Recent Price Increase and Currency Concerns

Gold prices have jumped more than 60% this year, climbing above $4,300 per ounce. This big increase has many investors wondering what it means for their money.

Some people call this the "debasement trade." This term describes the worry that governments might weaken their money's value by spending more than they take in and keeping interest rates low. Because of this and a weaker U.S. dollar, some investors are buying gold, which they see as something that holds its value over time.

While concerns about government spending are real, history shows that guessing where gold prices will go is hard. For long-term investors, the key question isn't whether to own stocks and bonds or gold. It's about how much of each to hold in a balanced portfolio.

What is currency debasement?

Currency debasement is an old idea that comes up every few years. It originally meant that governments would put less precious metal in their coins. This let them make more coins from the same amount of metal, but each coin was worth less.

Today, most money isn't backed by gold or silver. Its value comes from trust in the government that issues it. Modern debasement concerns focus on whether governments will allow higher inflation (rising prices) and a weaker currency to make their debts easier to manage.

However, the evidence that this is happening today is mixed. Inflation has been stubborn but not extreme—most measures show it at 3% or lower. Also, the bond market isn't expecting high inflation. The 10-year Treasury yield has recently fallen to 4% or less.

Two other important points: Central banks worldwide have been buying gold to strengthen their reserves, partly due to global uncertainty. And while the dollar has fallen about 10% this year, it's still relatively strong compared to the past twenty years.

Gold price movements are hard to predict

Gold has had dramatic price increases in the past with mixed results. In the late 1970s, gold surged to above $800—a level it didn't reach again until 2007. After the 2008 financial crisis, gold doubled from 2009 to 2011, reaching about $1,900 per ounce, then fell back toward $1,000 over the next few years.

The chart shows gold's performance compared to the S&P 500 stock index since 2007. While gold has had strong periods, the S&P 500 has still performed better over the full time period. This highlights why it's important to look at all investments as part of a complete portfolio.

Many investments have done well this year

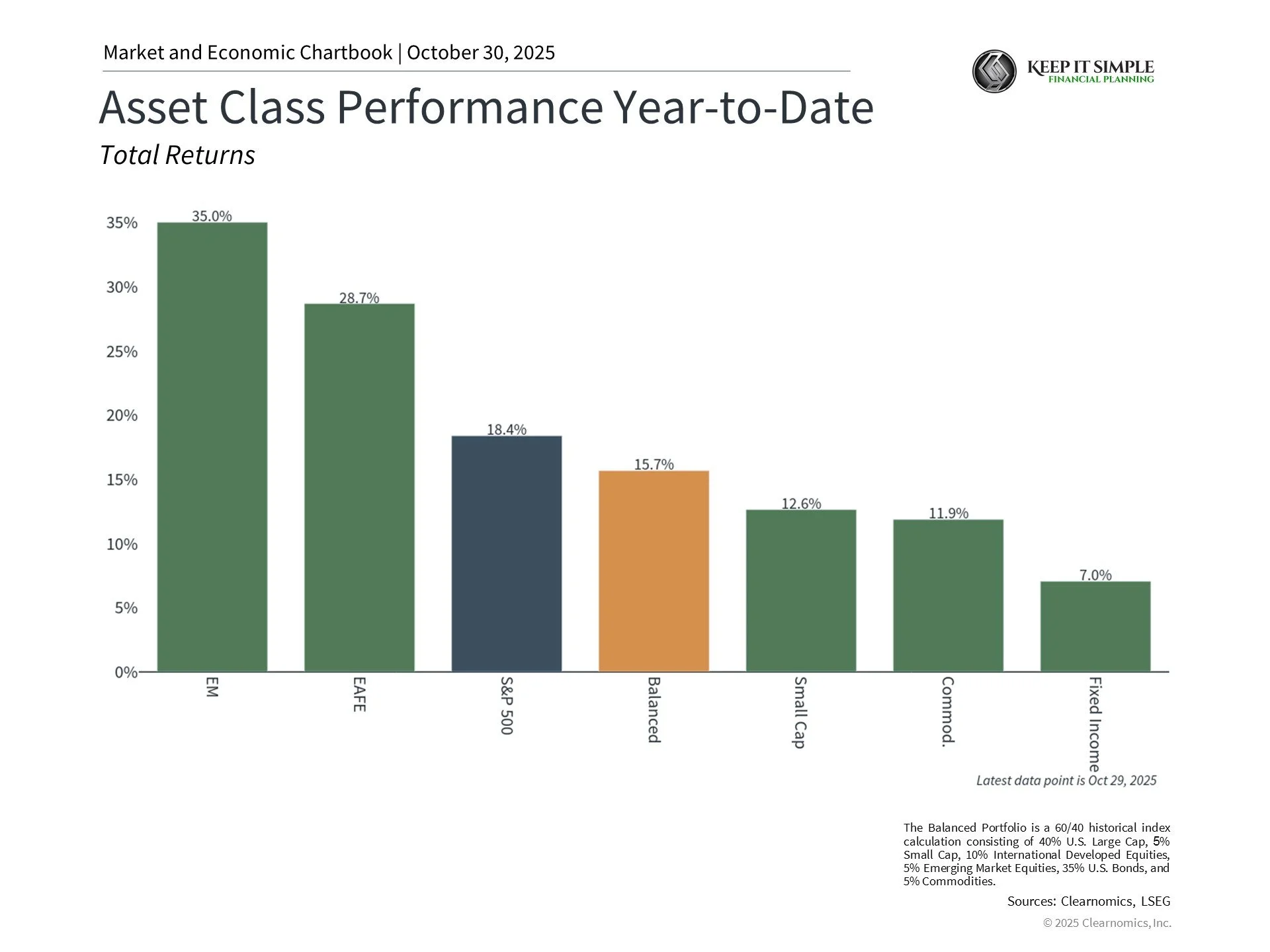

The current gold rally, which began in 2024, has happened alongside strong performance in many other investments, including technology stocks like the Magnificent 7, international stocks, bonds, and cryptocurrencies. The chart shows that many different types of investments have contributed to portfolio returns this year.

For many investors, gold plays a role as part of a broader mix of investments. But there's an important difference between gold and other investments: gold doesn't generate income like bonds or dividend-paying stocks do. A portfolio with too much gold gives up the long-term growth potential of stocks and the income from bonds.

The bottom line? While some investors are worried about the dollar losing value, especially as gold prices rise, it's important to view gold as just one part of a well-balanced portfolio that matches your long-term financial goals.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.