How to Plan for Retirement With Rising Costs and Longer Lives

If you're retired or getting close to retirement, your biggest concern is probably making sure your savings last. This has become harder recently because inflation (rising prices) has reduced what your money can buy. Today, costs remain high for things retirees need most, like healthcare, housing, and everyday items.

While stocks and bonds can help address this problem, some retirees worry about taking risks. Others wonder if their savings will be enough as living costs rise. Understanding how inflation affects retirement income is important for long-term investors.

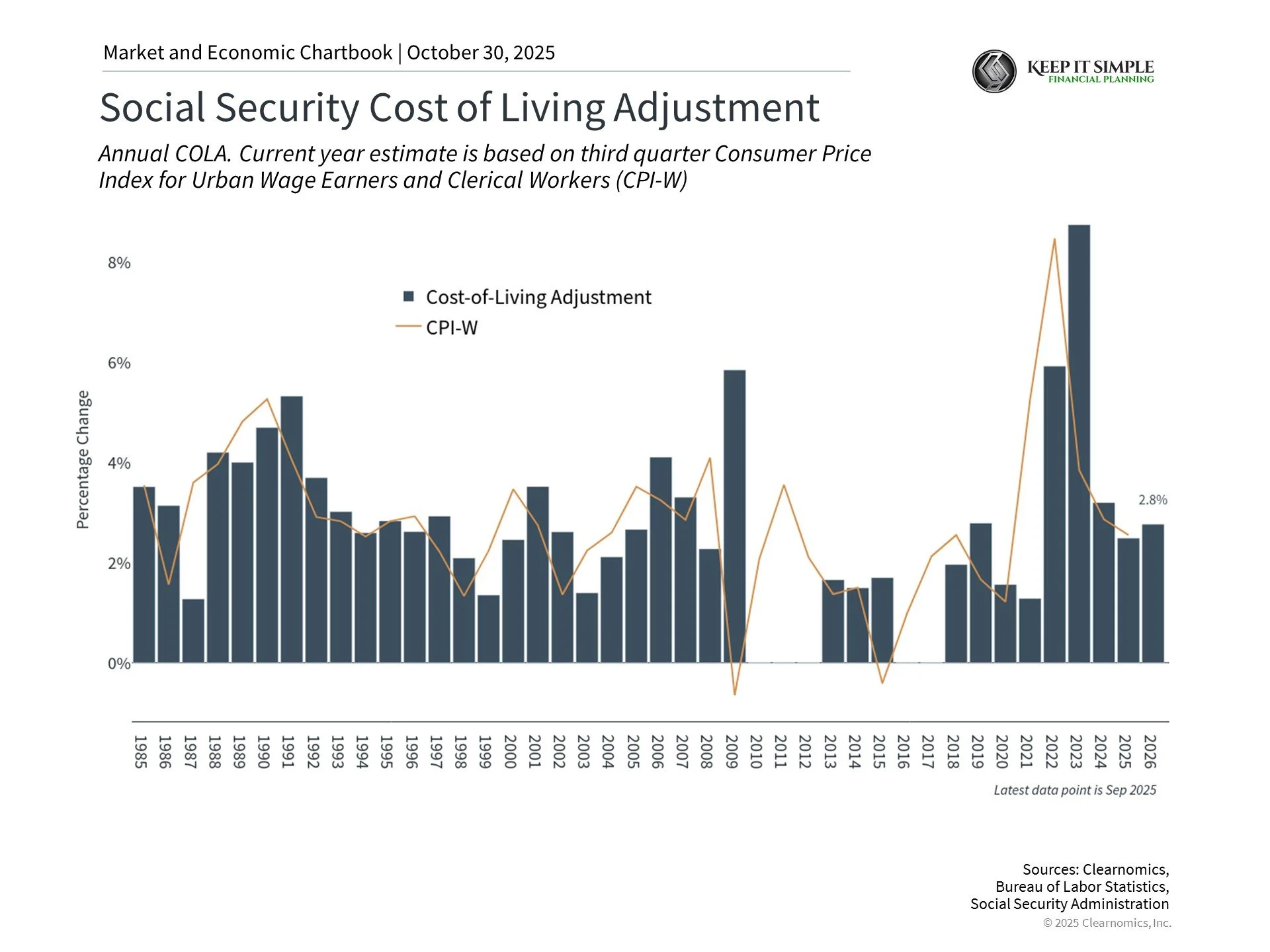

Social Security increases may not match your actual costs

The Social Security Administration recently announced a 2.8% increase for 2026. This raises the average monthly payment to $2,064, an increase of only $56. While helpful, this is much smaller than the 8.7% increase in 2023.

The problem is that retirees often face different price increases than younger workers. Healthcare, housing, and other costs that matter most to retirees have often risen faster than the official inflation measure suggests. For example, medical care services rose 3.9% over the past year, health insurance increased 4.2%, and home insurance climbed 7.5%.

Medicare Part B premiums (monthly fees) may also rise $21.50 in 2026. Since this is taken directly from Social Security checks, it would use up about 38% of the average $56 increase.

Living longer means your money needs to grow

People are living longer than previous generations. According to Social Security data, 65-year-olds can expect to live to age 83 (men) or 86 (women) on average. Some will live much longer—into their mid-90s.

A retirement lasting 30 years or more requires different planning than a 20-year retirement. Running out of money is a serious concern. This means you need investments that can grow over time, not just generate income. While bonds provide income, stocks have historically grown faster than inflation over long periods.

Falling interest rates mean less income from cash

The Federal Reserve (the Fed) is expected to continue lowering interest rates. This will reduce the interest income from cash and money market accounts. For retirees who have relied on this income, this presents a challenge.

Holding some cash for near-term expenses is important. However, relying too much on cash means missing out on growth from stocks and income from bonds. The combination of ongoing inflation and declining interest rates makes it harder for conservative investors. Cash loses value to inflation, and the interest it earns will decline.

The bottom line? Social Security increases alone aren't enough to protect against inflation. With people living longer and interest rates falling, retirees need portfolios that provide both income and growth over time.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.