How to Set Realistic Investment Expectations

The stock market has done well over the past few years, which is great news for investors. However, these strong returns can sometimes make people expect too much from their investments going forward. It's important to remember that investing happens during both good times and bad times in the market. While it's good to take advantage of opportunities and manage risk, it's equally important to set realistic expectations based on history and your personal financial plan.

Behavioral finance is a field that studies how people make investment decisions. Research shows that people often make choices based on emotions and mental shortcuts that can hurt their investment results. While we can't control what happens in the markets or the economy, we can control how we react to these events. The key is understanding these common mistakes and having a plan to avoid them.

Don't base decisions only on recent events

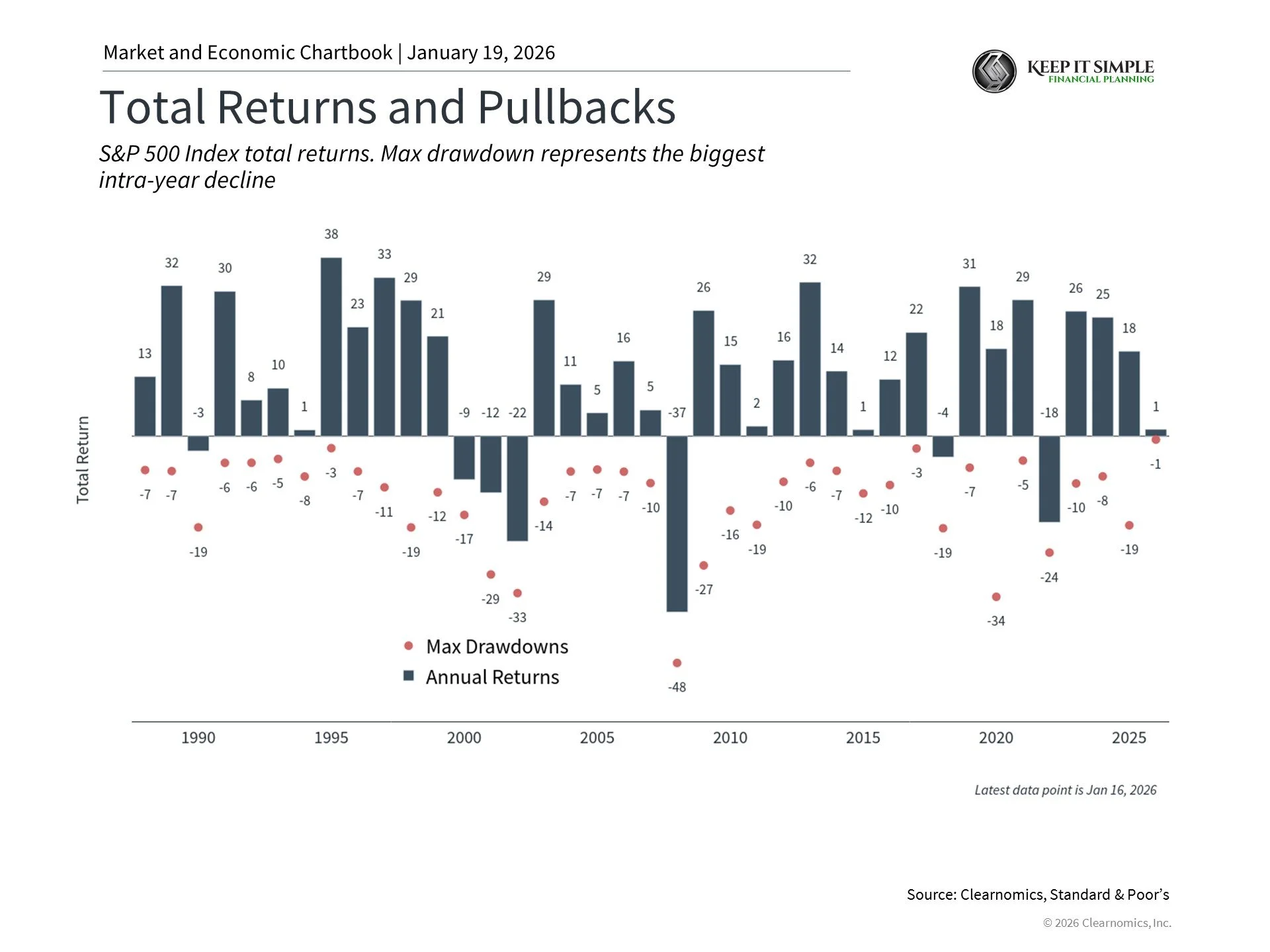

It's easy to make investment choices based on what happened recently. This is called recency bias, which means giving too much weight to recent events instead of looking at the full picture. After the S&P 500 had double-digit returns in six of the past seven years, many investors might think this is normal. But it's actually exceptional performance.

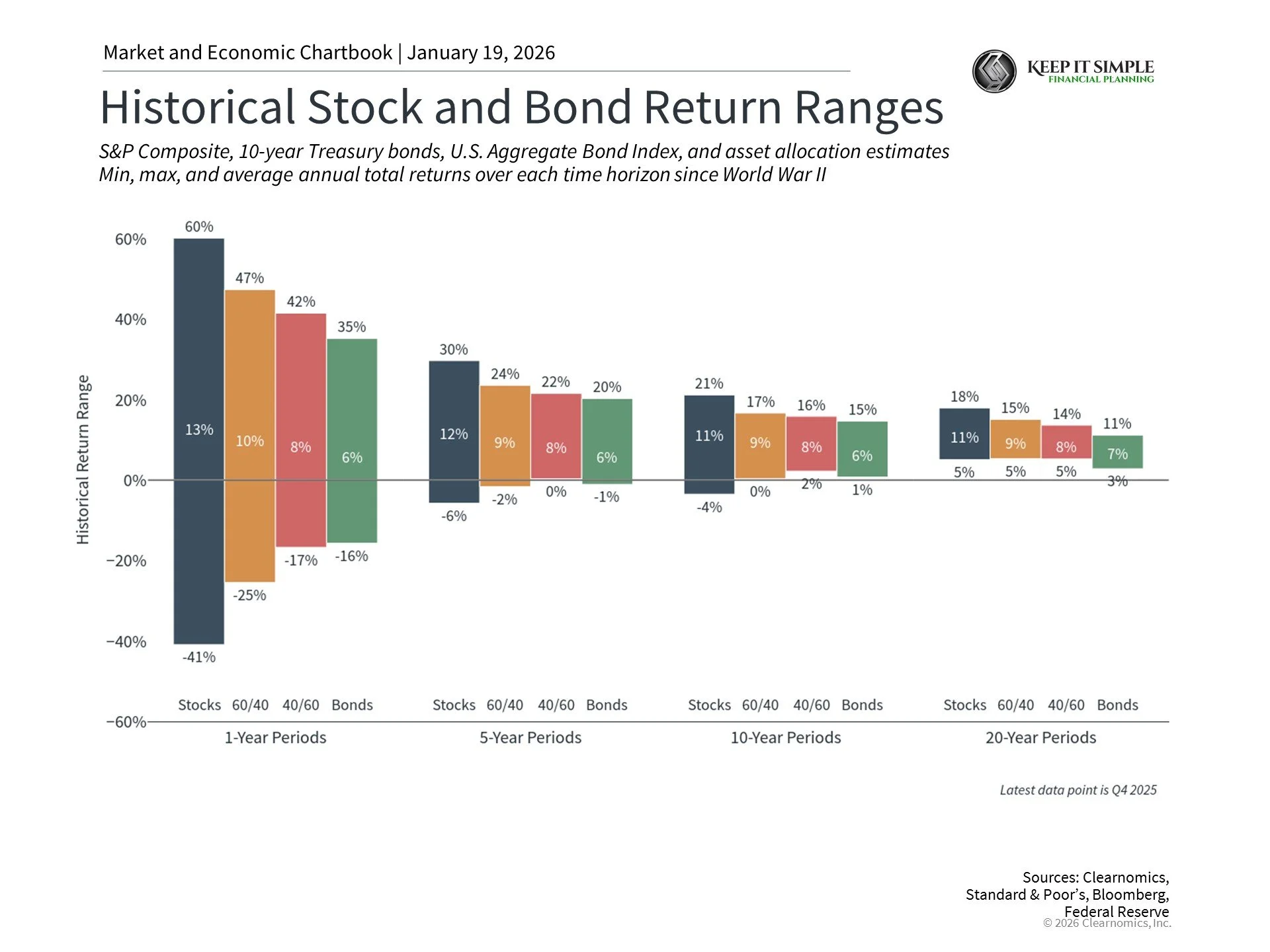

Looking at history, we see that the S&P 500 has averaged more than 10% returns per year over the long term. However, any single year can be very different from this average. Recent strong years don't guarantee future results. The key is to focus on the long-term positive trend rather than trying to predict what will happen next year.

The solution is to view recent performance in the context of market history. Strong returns are positive, but they should prompt you to review your portfolio to make sure it still matches your long-term goals.

Understand that losses feel worse than gains

Research shows that people feel the pain of losing money more strongly than the pleasure of gaining the same amount. This is called loss aversion. For example, losing $100 typically feels worse than winning $100 feels good. This matters because reaching your financial goals requires staying invested through both good and bad times.

The chart shows that even though the stock market has risen in two out of every three years, it often drops during the year before recovering. Investors who sell during these drops often miss the rebound that follows. Last year's market volatility is a good example of this pattern.

Look beyond just U.S. stocks

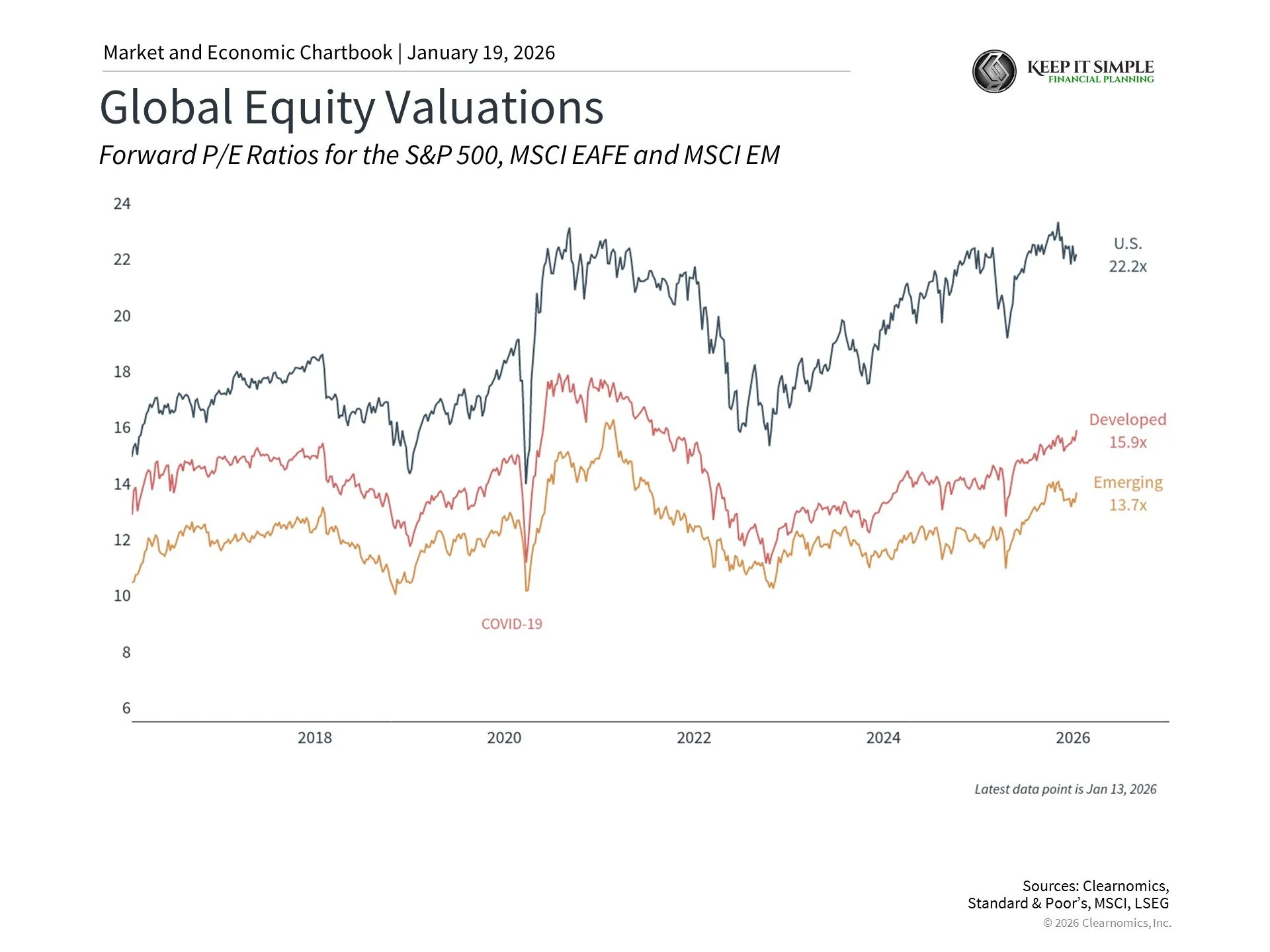

Many investors prefer to invest in what they know, often focusing too heavily on U.S. stocks. While U.S. stocks have done well over the past decade, this isn't always the case. In 2025, both developed and emerging market stocks outside the U.S. performed better than U.S. stocks.

Market leadership changes over time and is hard to predict. Right now, international stocks are cheaper than U.S. stocks, which could make them attractive investments. The goal isn't to maximize returns in any single year, but to create steady results over time by investing across different types of assets and regions.

The bottom line? After several years of strong performance, investors need to keep realistic expectations. History shows the stock market supports long-term growth, but this requires controlling emotional reactions to short-term market movements.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.