What the Venezuela Situation Means for Your Investments

U.S. forces recently arrested Venezuelan President Nicolás Maduro on drug trafficking and corruption charges. This unexpected event has made headlines around the world. President Trump said the U.S. will help run Venezuela and increase its oil production.

This situation affects many areas, including humanitarian concerns and regional politics. As an investor, you might wonder how this impacts your money. While these events can seem scary, looking at history helps us understand what to expect. Past geopolitical events have usually caused short-term ups and downs in markets, but they rarely change long-term investment results.

What history tells us about geopolitical events and markets

The U.S. has a long history of involvement in Latin America. This isn't the first time American forces have taken action in the region. In 1990, the U.S. captured Panama's leader Manuel Noriega on similar drug charges. Maduro has been facing U.S. criminal charges since 2020.

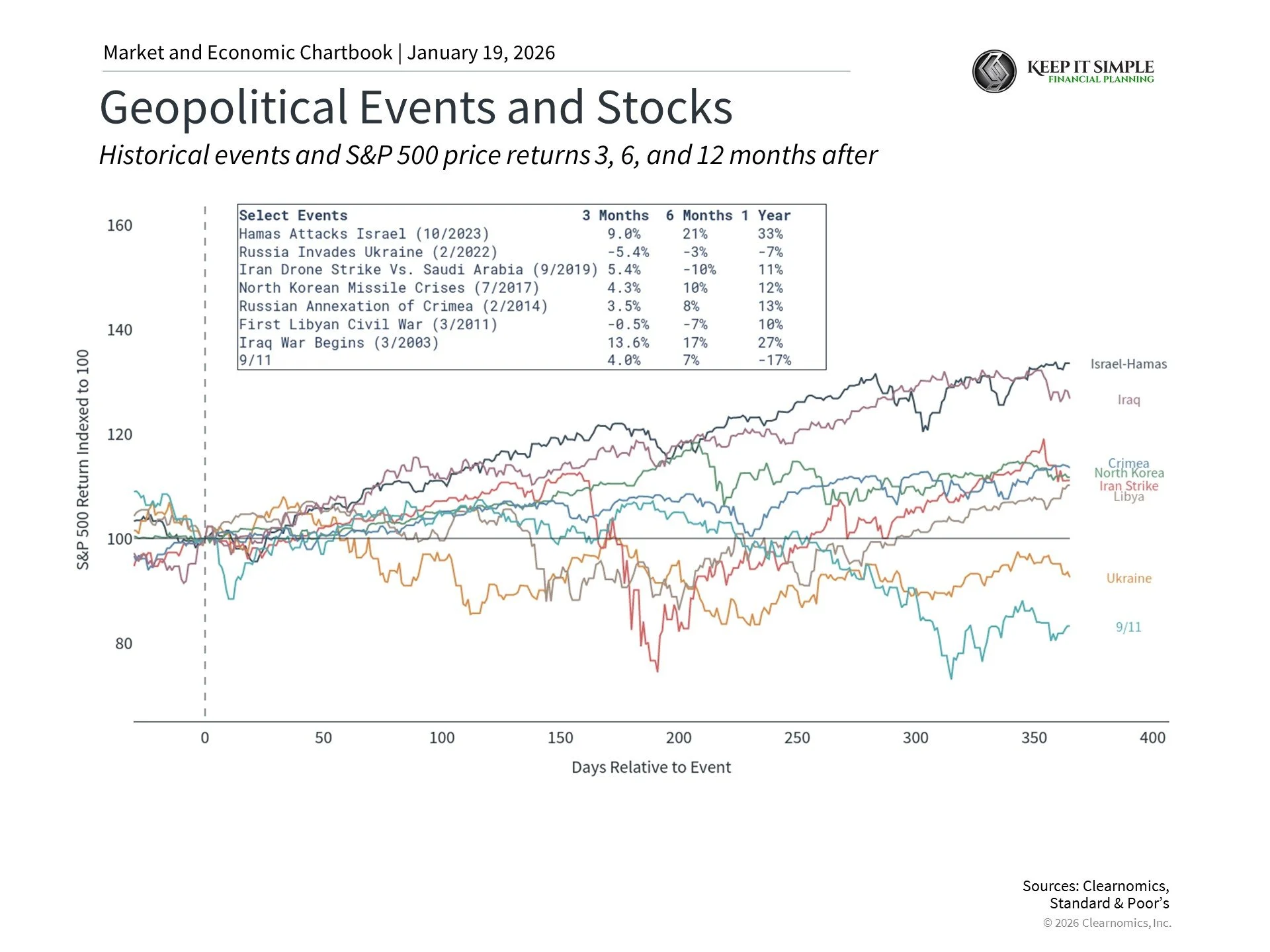

The chart above shows major world events from recent decades. In most cases, markets bounced back within weeks or months. This pattern is important for investors to remember. Geopolitical risk (meaning uncertainty from world events) is a normal part of investing, even though each situation is different.

Why oil prices matter to your portfolio

Oil prices are the main way these events can affect your investments. Venezuela has the world's largest oil reserves—about 304 billion barrels. That's even more than Saudi Arabia. However, Venezuela produces much less oil than other countries because of poor management and lack of investment. Today, it produces less than 1 million barrels per day, while the U.S. produces nearly 14 million.1

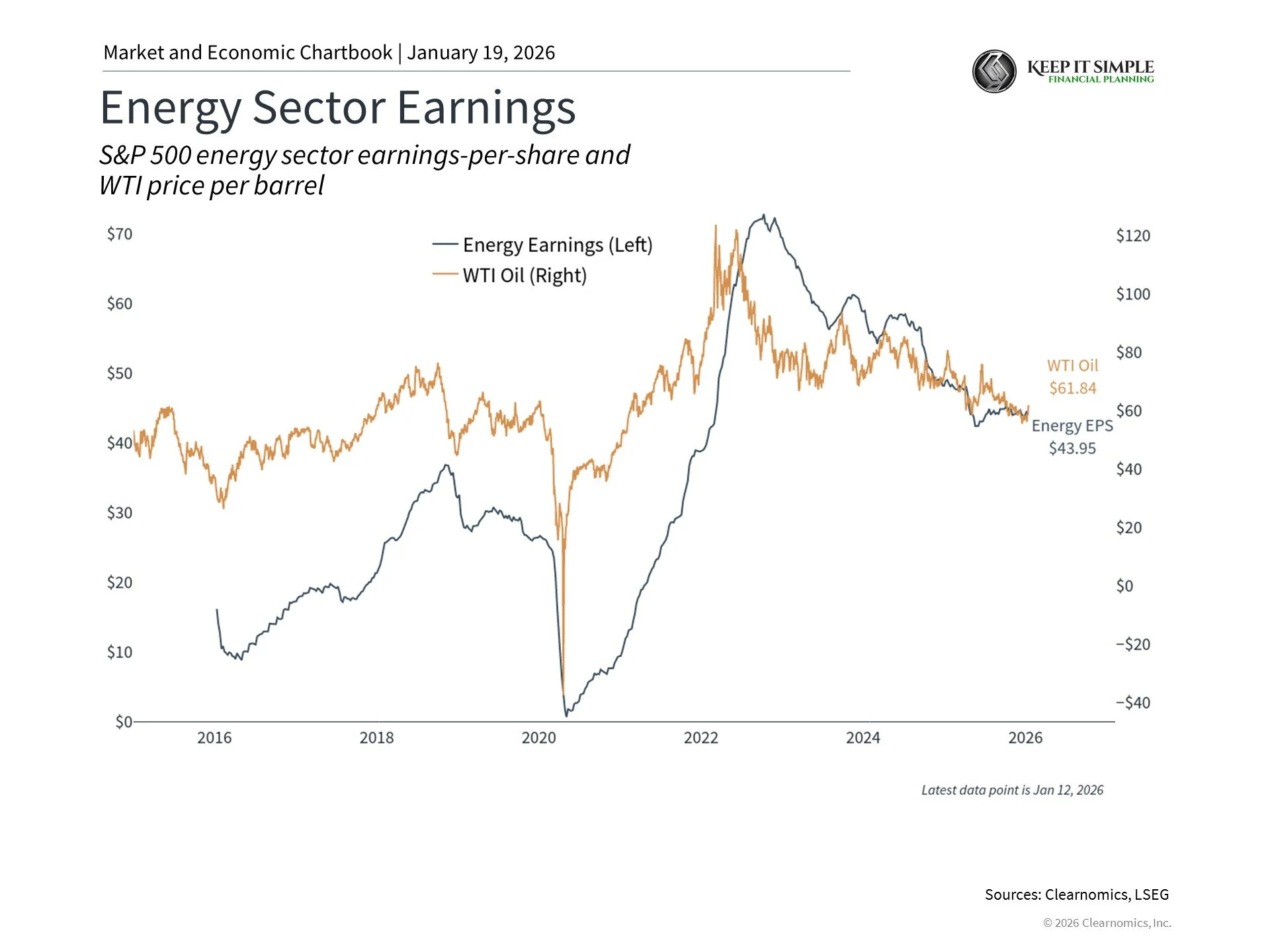

If Venezuela increases oil production, it will take time and money. This means the immediate impact on markets is small. Unlike Russia's invasion of Ukraine in 2022, which disrupted existing oil supply and pushed gas prices above $5 per gallon, the Venezuela situation could eventually lower oil prices by adding more supply. This would be good news for consumers and the broader economy.

Current oil prices are much lower than recent peaks. The U.S. is now the world's largest oil and gas producer, which helps protect our economy from price shocks. Remember that energy prices are hard to predict—many experts expected high prices after the Ukraine invasion, but they fell sooner than expected.

Venezuela's small role in investment markets

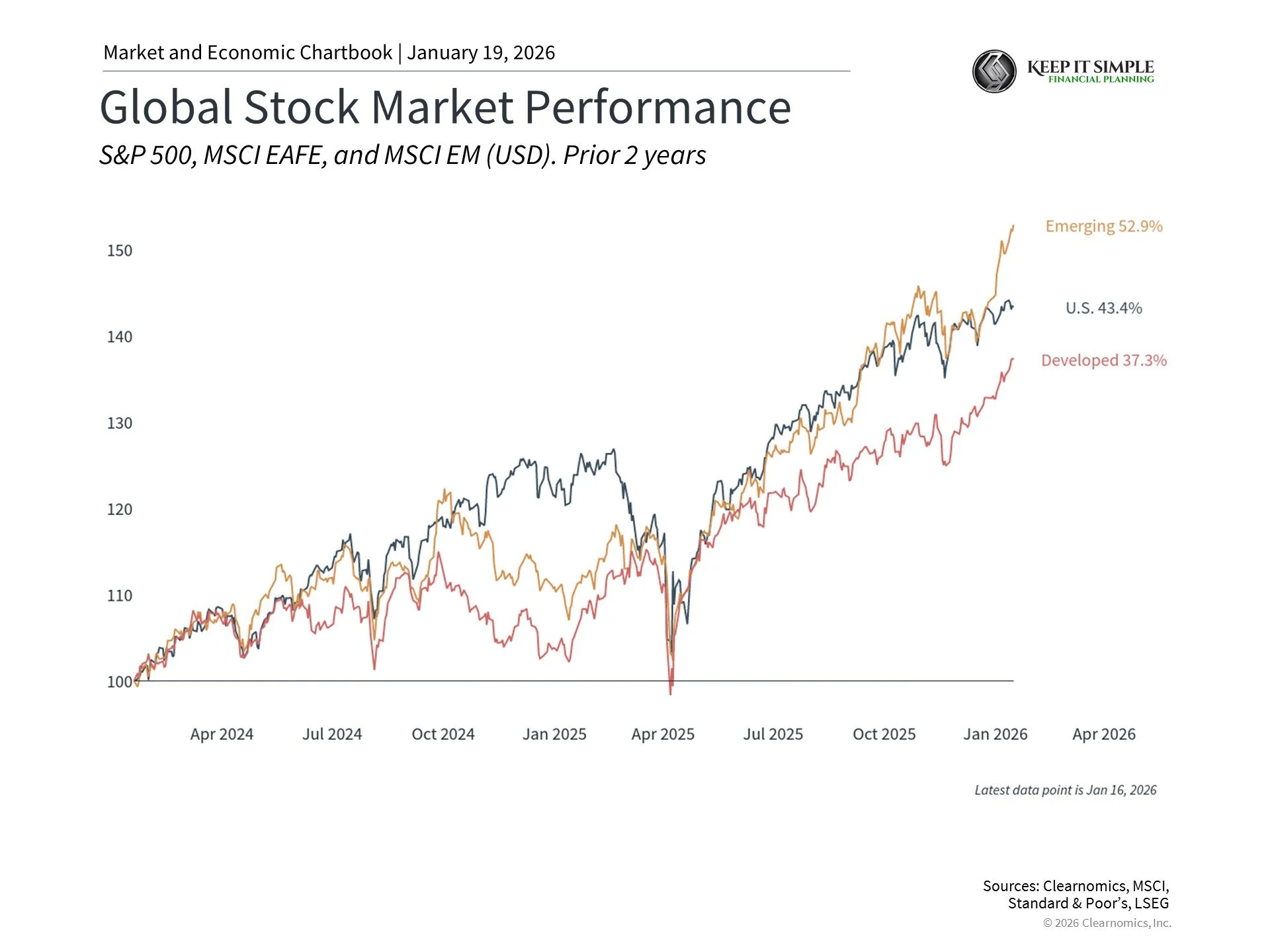

Here's good news: Venezuela plays almost no role in global investment markets. Its stock market is tiny, and most international investors have little or no money invested in Venezuelan companies. The country isn't even included in major emerging market indexes that track developing countries.

Venezuela has also been unable to pay its debts since 2017. This means the situation's effects on your portfolio will likely be indirect, mainly through oil prices and general market uncertainty, rather than direct losses from Venezuelan investments.

The bottom line? While the arrest of Venezuela's president is a major world event, history shows that well-diversified portfolios built for long-term goals can handle geopolitical uncertainty. Stay focused on your financial plan rather than trying to predict short-term market moves.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.

References

1. https://www.eia.gov/outlooks/steo/tables/pdf/3dtab.pdf