Understanding Recent Credit Market Concerns

There's an old saying that criminals rob banks because that's where the money is. Today, money isn't just in banks—it's spread across many different types of financial companies. After the 2008 financial crisis, policymakers tried to make banks safer, but this created new challenges. Recent bankruptcies have worried some investors about problems in credit markets. It's important to understand what this really means for your investments.

Since 2008, more lending has moved to companies called "non-depository financial institutions" (NDFIs). These include private credit funds, mortgage companies, and online lenders. Unlike banks, they don't take customer deposits, so they follow different rules. But banks are still connected—they've lent $1.2 trillion to these companies.1 This setup makes the financial system harder to see into, which is why it's sometimes called "shadow banking."

Recently, several cases of alleged fraud have made headlines. In September, a subprime auto lender called Tricolor collapsed after allegedly using the same cars as collateral for multiple loans. An auto parts supplier filed for bankruptcy around the same time. More recently, fraud allegations emerged against companies called Broadband Telecom and Bridgevoice.2,3

JPMorgan CEO Jamie Dimon said "when you see one cockroach, there are probably more." This comment worried investors. But are these cases signs of bigger problems, like what happened in 2008 or 2023? For long-term investors, managing risk means holding a balanced portfolio, not reacting to every news headline.

Today's situation is different from past crises

When credit problems appear, people often compare them to 2008 or 2023. The 2008 crisis was severe because large financial institutions had borrowed far too much money (called leverage). This created problems throughout the entire financial system.

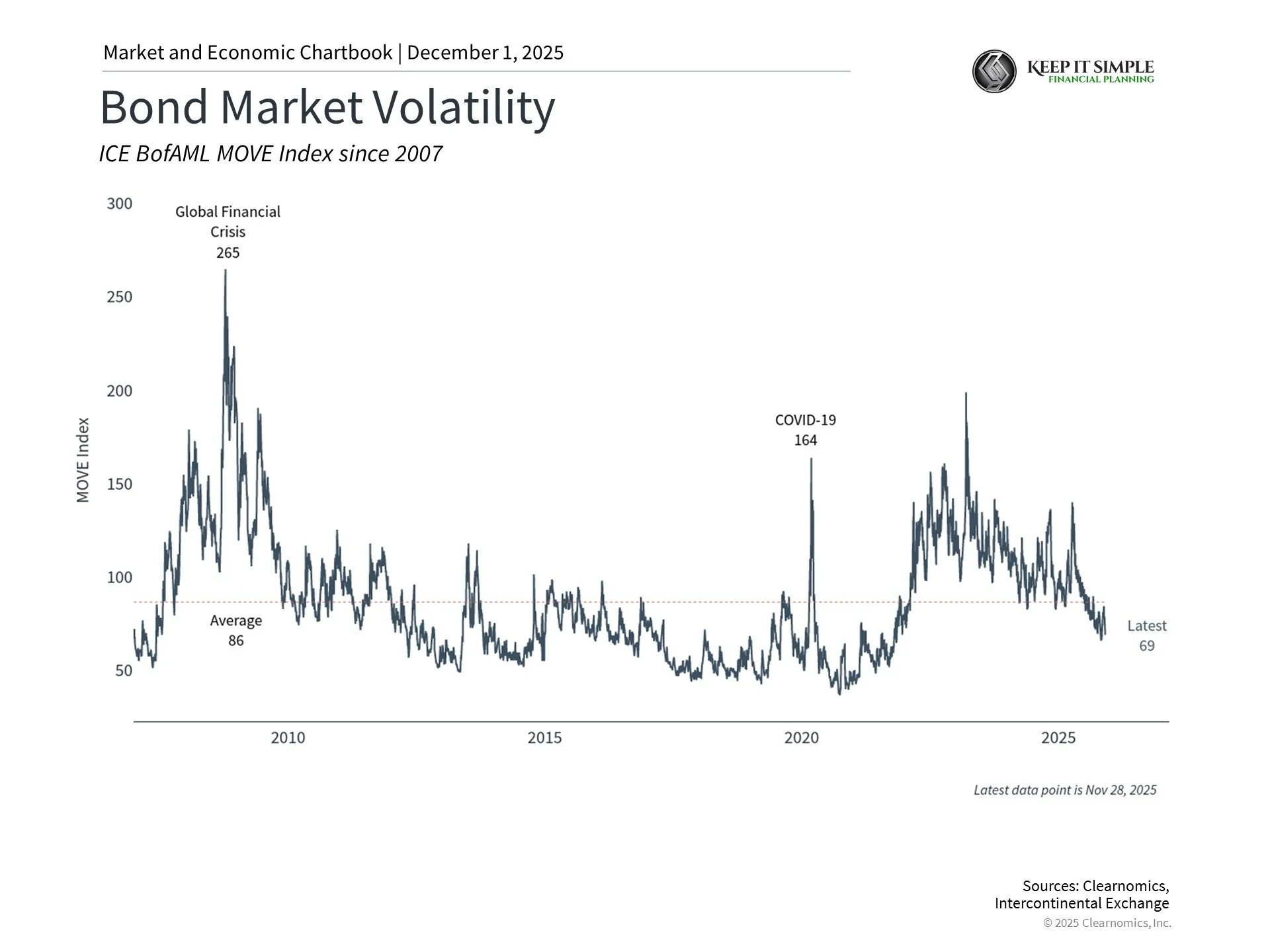

The 2023 banking crisis is a better comparison. Several regional banks failed quickly because of a mismatch between their assets and liabilities when interest rates rose. These banks had concentrated customer bases—like tech startups or cryptocurrency companies—which made them vulnerable. While concerning at the time, this didn't lead to a broader economic downturn. The chart above shows that bond yields and credit spreads (a measure of risk) remain stable today.

Credit cycles drive economic ups and downs

Throughout history, credit and debt cycles have driven major economic expansions and contractions. When money flows freely, businesses and individuals borrow more. This pattern has repeated itself from the railroad boom of the 1800s to the housing bubble of the mid-2000s.

For large banks, each bad loan matters because it affects their quarterly earnings. For long-term investors, what matters is whether problems are "systemic"—meaning they affect the broader economy and many different investments. The chart above shows that the banking system has been stable over the past two years.

Markets have remained relatively calm

tock and bond markets have experienced brief periods of uncertainty recently, driven by tariffs, government issues, and questions about AI companies. Yet major stock indices have continued reaching new highs, while bonds have also supported balanced portfolios.

The bottom line? Recent credit problems have raised concerns, but markets have calmed down. For long-term investors, these challenges highlight the importance of maintaining a balanced portfolio aligned with your long-term goals.

Want to learn how Keep It Simple Financial Planning can help? Please don’t hesitate to reach out here.

References

1. https://www.fitchratings.com/research/non-bank-financial-institutions/us-bank-lending-to-non-banks-continues-to-outpace-all-other-types-15-05-2025

2. https://www.bloomberg.com/news/articles/2025-10-31/is-a-private-credit-crisis-brewing-tricolor-first-brands-shake-wall-street

3. https://www.wsj.com/finance/blackrock-stung-by-loans-to-businesses-accused-of-breathtaking-fraud-6de5c3a7